What is a Chargeback?

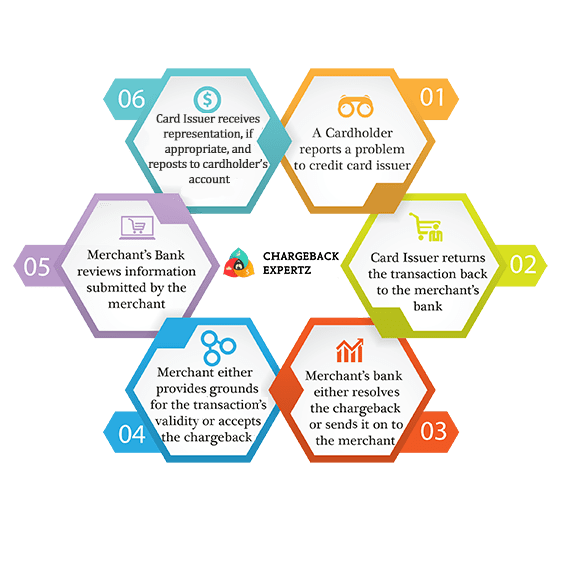

Chargeback is a mechanism by which a cardholder claims the merchant and calls the credit card issuer to dispute a transaction that had previously been credited. A cardholder may have various reasons to raise a dispute against the transaction like goods and services never supplied to the customer, defective merchandise received by a customer, refund not processed to the customer, merchant used the expired card and so on.

The Merchant needs to give an explanation about the amount debited from cardholder account.

What is Chargeback Representment?

Chargeback Representment is a term for providing Packet of Evidence as per Reason Codes to acquiring the bank or the Credit Card Company that shows that the transaction was made with full knowledge of the cardholder and also shows that cardholder agreed with all the Terms and Conditions which was displayed before buying the Product or Services. Chargeback also includes the information about Full Refund and Partial Refund issued to Cardholder.

When a Customer or Issuing Bank issues a chargeback, the merchant gets transaction information from acquiring a bank with given deadline to decide if the merchant is going to fight or not. If a merchant is ready to fight, he would have to provide all the information regarding the transaction in a single packet. Acquiring Bank will then send evidence to the Issuing Bank, where a team of experts will examine all the evidence and if the team gives a verdict in the merchant’s favor, the chargeback will be reversed and if the team is not satisfied with the submitted evidence, the particular amount is then deducted from the merchant’s account.

Tips on effective Chargeback Representment:

- Spot the Reason Code and collect evidence according to it.

- Collect all the evidence which was provided to the customer at the time of sale and arrange in a single packet.

- Always highlight Important key proofs of order id, tracking number, customer’s email id, IP address, order confirmation etc.

- Provide proof of Refund if Customer refunded before disputing the Chargeback.

- Provide all evidence which was signed by Customer before buying the Services.

Issues that stop you from a perfect Chargeback Representment:

-

- The important issue is time frame; Merchant should send all evidence before the deadline.

- Provide all evidence according to the reason code, there is no chance for mistake.

- Show all the agreement(s) signed by a customer in a proper manner.

- Provide refund receipt as a Proof of Refund

The merchant pays Real Cost of Chargeback:

- If Merchant loses a Chargeback dispute, they not only end up losing transaction; they have to pay more than that. The real cost pay by the merchant is shown below, using the example of selling Laptop:

Laptop Cost: $500.00

Shipping Cost: $15.00

Credit Card Fees: $13.50

Customer Service Fees: $3.50

Business Operating Fees: $5.00

Total Cost: $537.00

Chargeback Fees: $45.00

Total Cost of Chargeback: $582.00

The Merchant end up paying much more than the original Transaction Amount and the Shipping Charge.

![]()

Email us anytime!

Email customer service 24/7

![]()

Call us anytime!

Reach customer care 24/7 at +1 (727) 330-3944